Quick Answer

The Rockdale housing market exhibits a balanced mix of stability and growth potential. Ideal for both investors and homeowners, the suburb presents moderate turnover, driven by demand from families and professionals seeking proximity to Sydney’s CBD.

Key Takeaways

- Median House Prices: Generally falls within the range of $1.2 million to $1.5 million, though this can vary.

- Rental Yields: Typically around 3% to 4% gross yield; verification through real estate platforms recommended.

- Demographics: Predominantly families and young professionals.

- Lifestyle Factors: Proximity to parks, schools, and vibrant shopping districts.

Pros & Cons

Pros

- Proximity to amenities and transport

- Potential for capital growth, supported by ongoing gentrification

Cons

- Market volatility influenced by economic factors

- Possible oversupply in certain segments, particularly apartment units

Suburb Snapshot

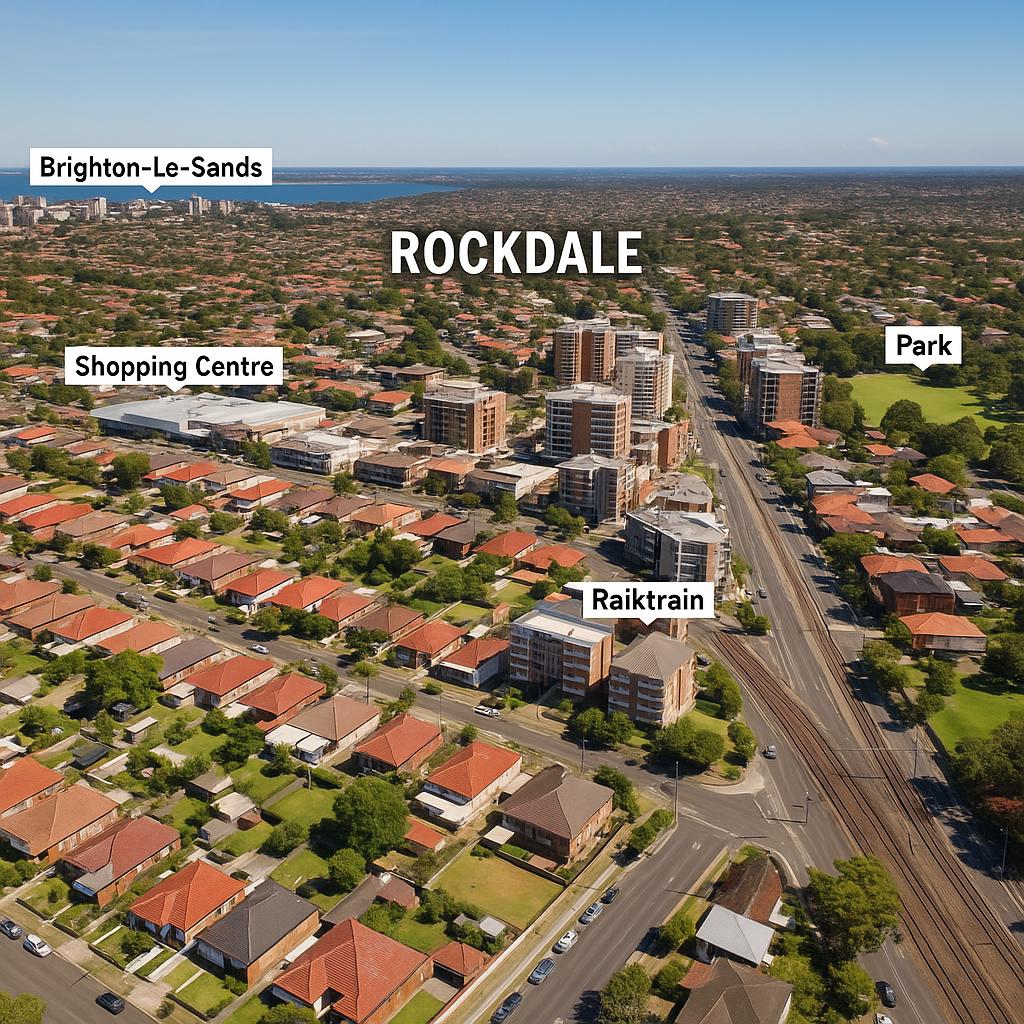

Rockdale is located approximately 13 kilometers south of Sydney’s central business district (CBD). Bordered by Botany Bay to the east, it combines coastal charm with urban conveniences.

Historically, Rockdale has demonstrated consistent growth, attributed to its redevelopment initiatives and improved infrastructure. The community is diverse, with cultural influences evident in local cuisine and events.

Investor View

Investing in Rockdale can be appealing for several reasons:

- Rental Market Dynamics: The rental market remains robust as diverse demographics seek accommodation.

- Successful Case Studies: Properties purchased at lower price points have shown appreciation as the area develops.

However, potential investors should be cautious of market risks, including economic fluctuations and regulatory changes concerning property legislation.

Homeowner View

For prospective homeowners, Rockdale offers a family-friendly environment characterized by:

- Access to quality schooling options, including public and private institutions.

- Vibrant local amenities, such as parks and recreational facilities.

Financially, buyers should weigh current mortgage rates against their income stability and home ownership goals.

Market Drivers

Several economic factors influence Rockdale’s market:

- Employment Rates: A mix of local businesses contributes to lower unemployment rates.

- Transport Links: Rockdale’s train station connects residents directly to the city, enhancing appeal.

Due Diligence Checklist

- Questions to Ask:

- What are recent sales prices in the area?

- How is the local school performance rated?

- Market Research Points:

- Examine historical growth patterns and current supply pipeline.

- Assess competing properties in similar price ranges.

- Steps for Financial Assessment:

- Get pre-approval and assess all costs, including stamp duty and ongoing maintenance.

Red Flags & Watch-Outs

Potential pitfalls for new investors include:

- Signs of a cooling market—observe changes in sales speed and listing prices.

- Oversupply: Be aware of any spikes in new developments that could affect property values.

FAQ

- What is the average time on market for properties in Rockdale? Typically, homes may remain on the market for about 30-60 days depending on pricing.

- Are there any upcoming developments in the area? Yes, there are various planned projects, including residential developments and infrastructure improvements. Consulting NSW Planning Portal for specific updates is recommended.

Conclusion

Rockdale offers appealing opportunities for both investors and homeowners, balancing lifestyle, access, and growth potential. Conduct thorough research and analysis to align your property goals with the dynamics of this vibrant suburb.