Quick Answer

Greystanes, situated in the 2145 postal code, exhibits strong rental demand with a promising trajectory for yields. As of recent analysis, rental yields hover in the range of 3.5% to 4.5%, while vacancy rates remain low, often below 2%. The suburb’s family-friendly amenities and ongoing infrastructural developments position it as a desirable market for both investors and homeowners.

Key Takeaways

- Strong rental demand supported by family-centric amenities.

- Consistent yield patterns backed by historical growth trends.

- Increasing scale of new developments catering to renters.

Pros & Cons

Pros

- Affordable rental options compared to adjacent suburbs.

- Convenient access to urban centers and public transport options.

- Thriving community setting with low vacancy rates.

Cons

- Competitive rental landscape may lead to price increases.

- Limited commercial activity compared to nearby urban areas.

- Concerns about potential overdevelopment impacting community feel.

Suburb snapshot

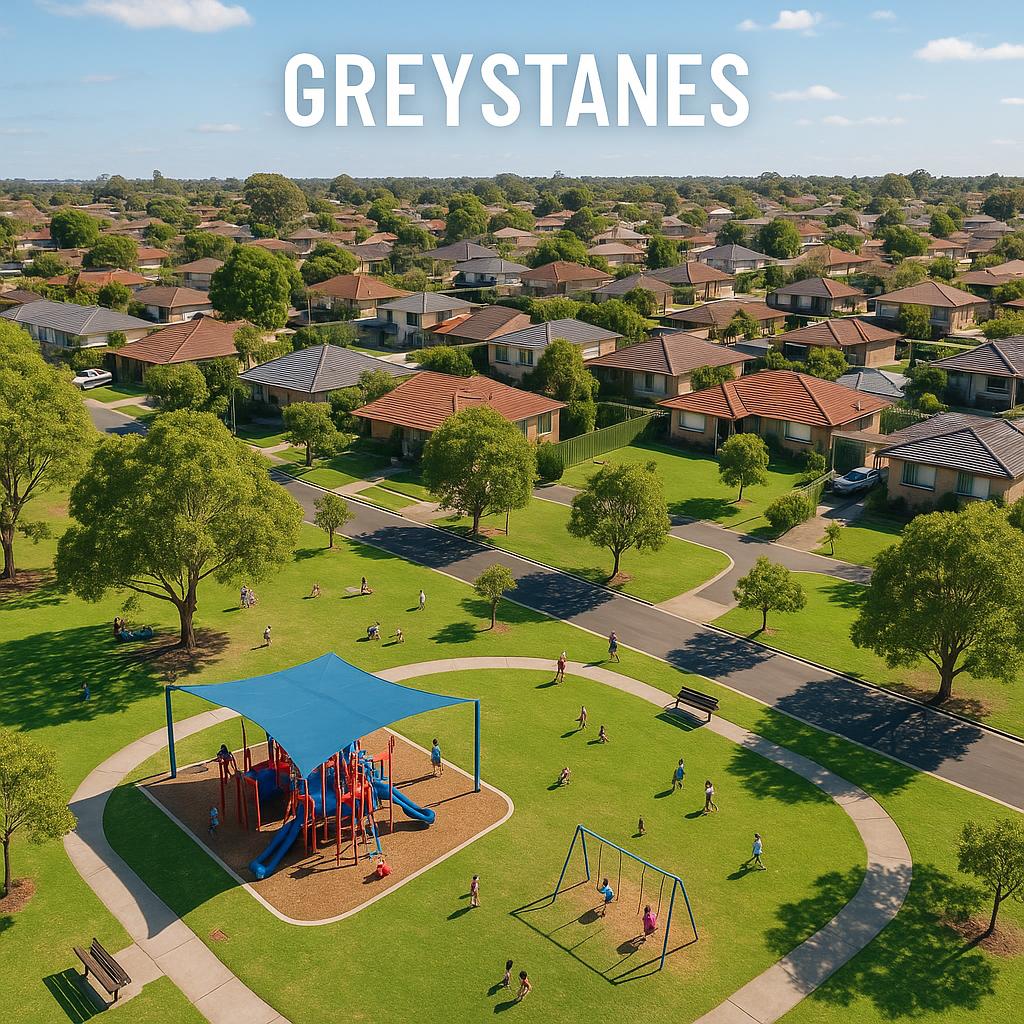

Greystanes has transformed from a primarily suburban environment into a vibrant community that attracts families and young professionals alike. Historically, the suburb was known for its spacious blocks and quiet streets, with a demographic comprised mainly of families, young couples, and retirees.

The suburb has shown a demographic profile with a median age of around 35, and households typically consist of three to four members. Housing types are diverse, with a mix of detached homes, townhouses, and apartments catering to various preferences.

Recent developments include new parks, schools, and enhancements to public transportation, making Greystanes a more attractive location for potential tenants and future homeowners.

Investor view

Current trends in Greystanes indicate a healthy market poised for further growth. Rental yields have remained stable, typically ranging from 3.5% to 4.5% depending on property type and location within the suburb. For instance, a well-located three-bedroom house may attract a rental return of approximately $650-$700 per week.

Consider the case of a successful investment by an investor who purchased a townhouse in a strategic location—close to schools and public transport—that has increased in value significantly while providing consistent rental income.

Investors should keep an eye on local government initiatives aiming to enhance the suburb’s amenities, which could drive further capital growth.

Homeowner view

Families are increasingly attracted to Greystanes due to its community feel, access to education, and recreational options. One family’s experience highlights the suburb’s advantages: they relocated from a busier urban area, valuing the balance of suburban living with proximity to essential services.

The growth of parks and schools, along with local sporting clubs, enhances the attractiveness of the suburb for families looking for a nurturing environment for children.

As the suburb matures, homeowners can anticipate property appreciation, bolstered by community development and upkeep.

Market drivers

Factors driving demand in Greystanes include efficient transport links, burgeoning educational institutions, and local amenities that cater to families. Job growth in nearby Parramatta further strengthens the suburb’s appeal.

The state government’s focus on infrastructure upgrades and community improvements is another substantial driver of the local market, enhancing both livability and property values.

Due diligence checklist

- Assess rental history data of specific properties to understand past yields.

- Investigate local zoning laws for future development plans.

- Examine community plans that could influence property values.

- Consult with local real estate professionals for insights on current trends.

- Conduct professional property inspections to uncover potential issues.

Red flags & watch-outs

- Keep an eye out for excessive rental properties coming to market, indicating potential over-saturation.

- Stay informed about legislative changes that could impact rental agreements.

- Be cautious of rapid development without planned supporting infrastructure.

FAQ

- What is the average rental yield in Greystanes? Rental yields typically range from 3.5% to 4.5%.

- Are there good schools in the area? Yes, Greystanes has several well-rated schools nearby, enhancing the suburb’s appeal for families.

- What types of properties are common in Greystanes? The suburb offers a mix of detached houses, townhouses, and apartments.

- How do I verify current rental prices in Greystanes? Use real estate websites or consult local agents for up-to-date listings and rental prices.

- Is Greystanes a safe area to live in? Generally, Greystanes is considered a safe suburb, but it’s recommended to check local community safety reports.

Conclusion

Greystanes presents a solid opportunity for investors and homeowners alike, combining consistent rental demand with community-oriented living. With ongoing development and investment in local infrastructure, the suburb is likely to continue its positive growth trajectory, making it a strategic consideration for property stakeholders.

Sources & how to verify

- Visit NSW Planning Portal for local zoning and planning information.

- Check Australian Bureau of Statistics for demographic insights and latest data.

- Refer to Real Estate Australia for current rental listings and price analyses.

- Consult Transport for NSW for recent transport upgrades.

- Examine local council updates through Cumberland Council.