Quick Answer

Randwick is poised for continued rental demand and potential yield growth through 2031, driven by its proximity to key amenities like universities and hospitals.

- Key Metrics at a Glance:

- High demand due to educational institutions

- Potential rental yield ranges: 3% to 5%

- Major factors: Infrastructure projects and demographic trends

Key Takeaways

- Strong rental demand from students and healthcare professionals.

- Projected yields in growth areas remain attractive for investors.

- Understanding local market dynamics is crucial for success.

Pros & Cons

Pros

- Diverse rental options catering to varied demographics.

- Ongoing infrastructure development enhancing property value.

- Rich lifestyle amenities, from parks to beaches.

Cons

- Rental price volatility may affect investor returns.

- High competition among landlords for tenants.

- Potential regulatory changes impacting rental agreements.

Suburb Snapshot

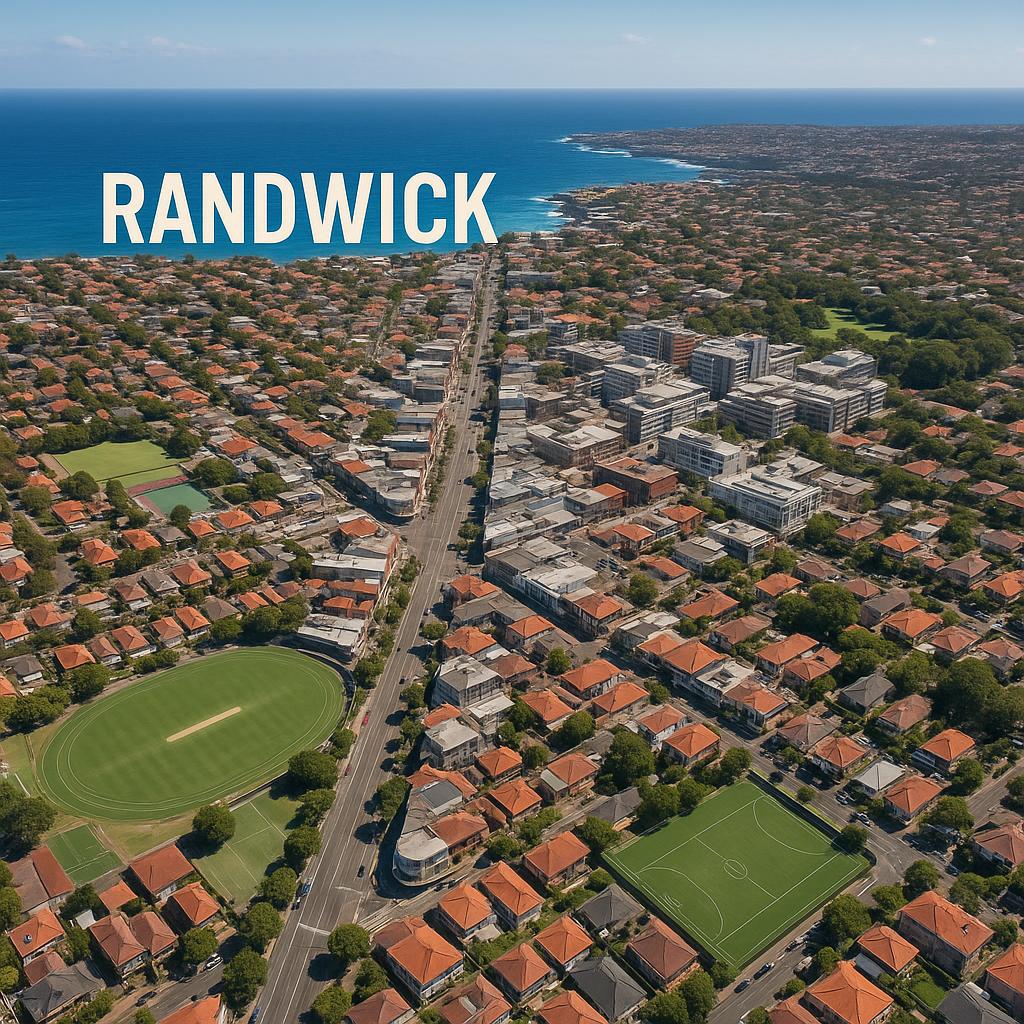

Randwick, located near the eastern suburbs of Sydney, boasts a rich mix of residential communities. Known for its diverse population, the suburb attracts students, professionals, and families alike.

Geographic Location and Demographics

Randwick is bordered by Coogee and Kingsford and features a blend of urban and natural landscapes, including parks and coastal areas.

Current Housing Stock

The housing market in Randwick is primarily composed of apartments, with a growing number of townhouses and family homes. This variety caters to different demographic needs.

Historical Performance

Historically, Randwick has experienced stable rental growth, supported by continuous demand from the education and healthcare sectors.

Lifestyle and Community Features

Rich in lifestyle options, Randwick features cafes, restaurants, and easy access to Coogee Beach, making it appealing not just for tenants, but also for long-term residents.

Investor View

For property investors, Randwick represents a strong investment opportunity due to its sustainable rental demand from several significant institutions.

Case Study: Successful Investment Stories

Investors in Randwick have reported considerable capital growth, especially in properties near university campuses, reflecting smart investment choices that leverage demand incentivized by location.

Projected Rental Yields

Investors can expect rental yields to range from 3% to 5%, particularly in emerging areas like southern Randwick.

Key Neighborhoods to Consider

- Near Randwick Junction for convenience and amenities.

- East of Alison Road for proximity to the beach and parks.

- Areas near the Prince of Wales Hospital for strong tenant demand.

Homeowner View

Living in Randwick offers benefits beyond just investment potential. Community culture and access to lifestyle amenities enhance property desirability.

Personal Story from a Homeowner

A current resident highlights the community spirit, combined with proximity to shops and transport as key motivators for their choice to invest in Randwick.

Impact of Nearby Amenities on Property Values

Homes near hospitals and universities generally maintain higher value, highlighting the importance of understanding community amenities when investing or buying in Randwick.

Market Drivers

Several key drivers support strong rental demand in Randwick:

- Close proximity to universities makes it appealing for students.

- The presence of major hospitals ensures a steady flow of medical professionals seeking accommodation.

- Upcoming transport projects further enhance accessibility.

Due Diligence Checklist

- Conduct thorough property inspections.

- Perform market comparison analyses for rental prices.

- Research local regulations governing rentals.

- Review recent sales data for informed decisions.

- Connect with local real estate agents for insights.

Red Flags & Watch-Outs

Investors should remain cautious of:

- Market fluctuations that can impact rental income stability.

- The need for comprehensive tenant screening to avoid potential issues.

- Hidden fees associated with property management.

FAQ

- What is the average rental yield in Randwick? Rental yields may range between 3% and 5%, varying by property type and location.

- How do rental prices compare with neighboring suburbs? Randwick’s rental prices are competitive but often slightly elevated due to demand from students and healthcare staff.

- What amenities increase rental demand? Proximity to universities, hospitals, and public transport significantly boosts appeal.

- What’s the best kind of property for rental investment in Randwick? Apartments near the Randwick Junction area typically attract consistent demand.

- How often do rental prices fluctuate? Prices may vary seasonally; monitoring local market trends is essential.

Conclusion

Randwick presents an appealing landscape for both investors and homeowners alike. With its sustained rental demand, diverse amenities, and solid historical growth patterns, thorough research and informed decision-making are essential for maximizing potential in this suburb. Engage with local data and community insights as you navigate this vibrant market.

Sources & how to verify

- Visit Transport for NSW for transport links and upcoming developments.

- Check NSW Planning Portal for infrastructure plans.

- Refer to the Australian Bureau of Statistics for demographic insights.

- Utilize Domain for property comparisons and sold data.

- Consult Realestate.com.au for rental listings and market trends.